Balancing Worksheet

Run the Balancing Worksheet to obtain an audit trail of new patient records, production, collection, and adjustment transactions posted to your system. We recommend you finalize the report every working day to have an accurate audit trail. You can run preliminary reports as often as you wish, while continuing to

accumulate transactions. Once you request a final report,

each transaction on that report is permanently assigned to the report number. Transactions posted after you request a final report are assigned to the next sequential report number. We recommend that you save a printed or digital copy of all final reports, although under normal circumstances you can

regenerate any previous report upon request.

-

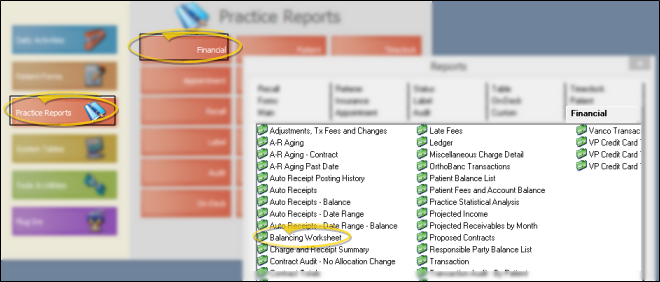

Open the Report - ViewPoint main menu > Practice Reports > Financial > Balancing Worksheet.

Open the Report - ViewPoint main menu > Practice Reports > Financial > Balancing Worksheet.

-

Report Settings Select the options to use for choosing records and generating this report. Choose carefully, as your selections will affect which data is included in the report.

Report Settings Select the options to use for choosing records and generating this report. Choose carefully, as your selections will affect which data is included in the report.

Report type - Choose Preliminary to generate a report of all transactions that are not yet finalized; choose Final to generate the report and finalize transactions for the day; select Old to generate a closed report.

Old Report Date / Report Number - (This is ignored for Preliminary and Final reports, which include all non-finalized receipts.) Select to generate an Old report, then enter either the date to print, or the Transaction report number to use. This is useful for locating a specific transaction that occurred in the past.

Office - Choose to include only the records for a specific office, or include the records for all office locations in your practice.

Doctor - Choose to include only the records for a specific doctor, or include the records for all doctors in your practice.

-

Output Options - After selecting the report settings, click Ok to continue to your output choices. See "Manage Record Selection & Output" for details.

Report Sections - This report includes multiple sections, each detailing specific events or transactions that were posted to your ViewPoint system. All sections include the patient name, primary ID code, responsible party name, transaction date, description, and amount. Each section ends with a sum of all transactions in that section.

Report Sections - This report includes multiple sections, each detailing specific events or transactions that were posted to your ViewPoint system. All sections include the patient name, primary ID code, responsible party name, transaction date, description, and amount. Each section ends with a sum of all transactions in that section.

New Patients - This section lists all of the patient records that were created from scratch, or by promoting a sibling record. The list includes the patient name, primary ID code, responsible party name, primary referrer, and the date the record was created. If multiple responsible parties are linked to the patient, the patient will be listed with each responsible party name separately. The section ends with the total number of records, not necessarily the number of patients, created.

Production - This portion of the report includes two sections:

New Treatment Fees - These transactions include the full treatment fee amount of new contracts. This includes contracts created by allocating part of an existing contract to a new billing party, as well as contracts created for new patients or new treatment phases. Contract proposals are not included in this calculation.

Miscellaneous Charges - This section lists miscellaneous charges posted for a positive amount, excluding those flagged as "Non-Orthodontic Charge". Descriptions that appear in parentheses indicate the transaction was both posted and reversed on this report. Reversal offsets, "Non-Orthodontic Charge" transactions, and charges posted for negative amounts are included in the Miscellaneous Charge Adjustments section of the report, described below. See "Transaction Types Table" for details about flagging certain charge descriptions as "Non-Orthodontic Charge" .

Collection - This section lists all receipts posted for a positive amount. The description includes the type of transaction posted: ca = cash; cc = credit card; et = electronic transfer; mo = money order; ot = other.

Special Transactions - Transactions flagged with posting fix include an asterisk ( * ) in the description; Transactions that were both posted and reversed on this report include an asterisk ( * ) and appear in parentheses. Reversal offsets and receipts posted for negative amounts are included in the Receipt Adjustments section of the report, described below.

Summary - The section ends with totals for each type of transaction, as well as a grand total. Note that the deposit total and transaction total are listed separately. While all receipt transactions are included in the Total column of the summary, reversed transactions and transactions flagged as Posting Fix (both indicated by an asterisk ( * ) in the description), are omitted from the Deposit total.

Adjustments - This portion of the report details adjustments to your Production and Collection totals, and includes four sections. Each section ends with the total amount for that type of adjustment: The sum of all Production adjustments, as well as the total adjustment amount for all sections are included in the Summary section at the end of the report.

Treatment Fee Adjustments - This section lists treatment fee changes that were applied to patient contracts via the Adjustments tab of the Contract Editor.

Changed Treatment Fees - These transactions include treatment fee amounts that were changed via the Contract Editor, excluding changes that were applied via the Adjustment tab. This includes changes to billing party allocations that result in $0 actual difference, as well as changes that result in increased or decreased total fees.

Receipt Adjustments - This section lists receipt reversal offsets, as well as receipts posted for negative amounts. If a receipt was both posted and reversed on this report, the original transaction in the Collection section of the report will be indicated by an asterisk ( * ) and appear in parentheses.

Miscellaneous Charge Adjustments - This section lists miscellaneous charge reversal offsets, charges flagged as "Non-Orthodontic Charge", charges posted for negative amounts, and transactions posted as Adjustments. If a charge was both posted and reversed on this report, the original transaction description in the Production > Miscellaneous Charges section of the report will appear in parentheses. See "Transaction Types Table" for details about creating your list of charge adjustment descriptions.

Report Summary - The Balancing Worksheet summary calculates your total production, collection, and accounts receivables balance.

Report Summary - The Balancing Worksheet summary calculates your total production, collection, and accounts receivables balance.

(a) Previous Account Balance - This number is carried over from the total account balance on the previous Balancing Worksheet report.

(b) New Treatment Fees - This number matches the Production > New Treatment Fees total on this report.

(c) Misc. Charges - This number matches the Production > Miscellaneous Charges total on this report.

(d) Gross Production (b+c) - This number is the sum of the New Treatment Fees and Miscellaneous Charges amounts.

(e) Gross Collection - This number matches the Collection > Grand Total > Total (not necessarily deposits) on this report.

(f) Treatment Fee Adjustments - This number matches the Adjustments > Treatment Fee Adjustments total on this report.

(g) Changed Treatment Fees - This number matches the Adjustments > Changed Treatment Fees total on this report.

(h) Misc. Charge Adjustments - This number matches the Adjustments > Miscellaneous Charges total on this report.

(i) Total Production Adjustments - This number is the sum of the Treatment Fee Adjustments, Changed Treatment Fees, and Miscellaneous Charge Adjustments amounts.

(j) Collection Adjustments - This number matches the Adjustments > Receipt Adjustments total on this report.

(k) Total Adjustments (i-j) - This number is the difference between the Production Adjustment total and the Collection Adjustment total on this report.

(l) Net Production (d+i) - This number is the sum of the Gross Production and Total Production Adjustments amounts.

(m) Net Collection (e+j) - This number is the sum of the Gross Collection and Collection Adjustments amounts.

(n) Net Account Balance Change - This number is the result of Gross Production - Gross Collection + Total Adjustments.

(o) Total Account Balance (a+n) - This number is the sum of the Previous Account Balance plus the Net Account Balance Change. Once you finalize this report, this Total Account Balance will become the Previous Account Balance for the next Balancing Worksheet.

Balancing Worksheet vs. Transaction Report - When you run a final Balancing Worksheet or Transaction Report, you finalize the transactions and advance the report number for both reports. If you generate an old report number for both types of reports, you will notice that the Previous Account Balance and Total Account Balance totals are the same, but the other calculations are likely different. Although each report uses the exact same transactions for its calculations, certain transactions are categorized differently, depending on which report you run. Please refer to the descriptions of each report to determine which calculations are most relevant to your practice's financial reporting requirements.

Balancing Worksheet Summary - Run the Balancing Worksheet Summary report to obtain a summary of the production, collection, and adjustment

transactions that appear on one or more final Balancing Worksheet reports for any range of dates or final report numbers. For each transaction type, the report includes the number of posted transactions and the average and total amounts for that type. The report is designed to be printed at the end of each month to include all transactions entered for that month. However, it can be used for any desired range of dates. See "Balancing Worksheet Summary" for details.

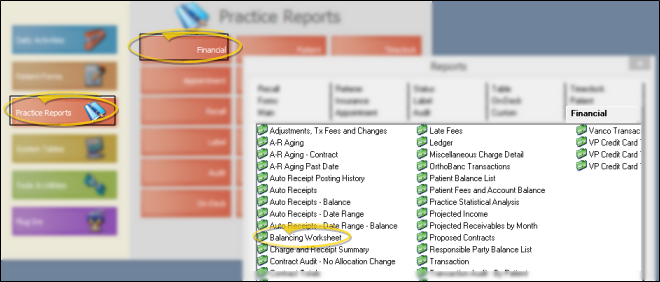

Open the Report - ViewPoint main menu > Practice Reports > Financial > Balancing Worksheet.

Open the Report - ViewPoint main menu > Practice Reports > Financial > Balancing Worksheet. Report Settings Select the options to use for choosing records and generating this report. Choose carefully, as your selections will affect which data is included in the report.

Report Settings Select the options to use for choosing records and generating this report. Choose carefully, as your selections will affect which data is included in the report. ![]() Report Sections - This report includes multiple sections, each detailing specific events or transactions that were posted to your

Report Sections - This report includes multiple sections, each detailing specific events or transactions that were posted to your ![]() Report Summary - The Balancing Worksheet summary calculates your total production, collection, and accounts receivables balance.

Report Summary - The Balancing Worksheet summary calculates your total production, collection, and accounts receivables balance.